What Does Let's find you the right Business Owners Policy - CoverHound Do?

Excitement About Business Owner's Policy (BOP): What It Is, How to Get One

They may also have limitations if a main company property measures over or under a defined area. Usually, organizations classes eligible for BOPs consist of retailers, apartment, small dining establishments, and office-based businesses.

What Is a Business Owner's Policy (BOP)?

Commercial Car Insurance This insurance covers automobiles used for service functions, consisting of: Cars Pickup Box trucks Service utility trucks Food trucks GEICO does presently use insurance coverage for semi-trucks and tractor-trailers. Why do you need business auto insurance coverage? Individual automobile insurance coverage does not always cover business use. Without business vehicle insurance coverage, you're at threat of: Having actually restricted or no protection for accidents Paying out of pocket for repairs, injuries, and more Losing your individual automobile protection Lots of tasks and agreements require business automobile insurance coverage, which GEICO can supply.

Business Owners Policy – Serving Arizona - Simple Insurance of Arizona

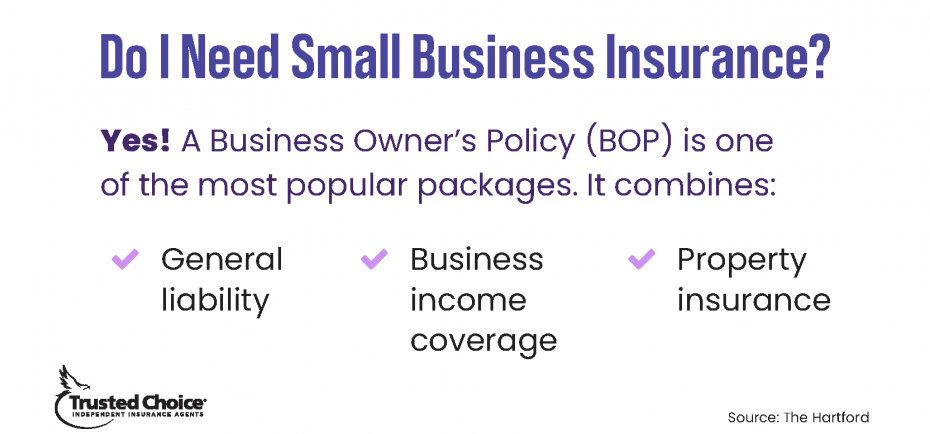

Company owner's Policy, Conserve money with an insurance package that covers common claims and home damage. What sort of work do you do? Get Quotes, We partner with relied on A-rated insurance coverage business, Company owner's policy, An entrepreneur's policy (BOP) packages general liability insurance with industrial residential or commercial property insurance. It usually costs less than if the policies were bought separately.

Some Ideas on Business Owner's Policy - Smart, Fast, Friendly Digital You Need To Know

Most small companies require general liability insurance coverage and industrial property insurance when they lease or own a workplace or other commercial area. On top of that, customer agreements often require basic liability coverage. Even when protection isn't needed, a BOP is a sensible option for small companies that work straight with the public and own property.

A BOP is particularly developed for low-risk small companies. If you certify, your organization saves cash and gains protection for the most common claims. What does a business owner's policy cover? An entrepreneur's policy consists of both basic liability insurance coverage and commercial property insurance, sometimes called service hazard insurance. Together, they offer liability and home protection for your little service.

It likewise pays legal expenses related to advertising injuries, consisting of character assassination and copyright violation. Services that rent business area, have a home loan, or deal with expensive client residential or commercial property are frequently required to carry this kind of coverage. Find More Details On This Page or commercial property insurance coverageCommercial home insurance coverage spends for repair work or replacement of damaged, ruined, or taken service residential or commercial property.